L.L. Bean - Social Media Monitoring Post 1

L.L. Bean is a century-old outdoors company based in Freeport, Maine. It is most famous for its signature "Bean Boot" and forgiving return policy. So what's so exciting about 2018, of all of L.L. Bean's years in business? Well, on February 9, 2018, L.L. Bean announced that it would be scrapping the lifetime return policy that its customers raved about. Closing the doors on this policy was a bold move on the company's part, but according to the Associated Press, over the last five years L.L. Bean has lost upwards of $250 million USD on merchandise returned to the store. Even worse is that monetary loss was only captures how many items were so damaged and worn beyond repair that the company couldn't recycle scraps for new products or donate them. For anyone who can empathize with the company's financial situation from a distance, the news is easy to swallow. But how are L.L. Bean's loyal following taking the news? As an L.L. Bean customer and brand loyalist myself, I am interested to see how the company navigates this rocky PR terrain. Through closely monitoring search trends, social media posts and how fans are engaging with their media, I hope to gain greater insight into their recovery strategy. And, hopefully, see a company who still makes customer service a top priority.

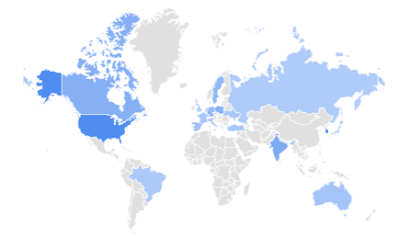

Who Are L.L. Bean's Fans?

|

| Who's been Googling "L.L. Bean" over the past 30 days? (Answer: they're highlighted in blue, above). Data Source: Google Trends |

According to Google, the image (below) is generally what L.L. Bean's internet traffic looks like each year. The blue line represents the quantity of Google Searches that included "L.L. Bean". The volume of searches triples leading up to the Christmas holiday, which lends some great insight into who their fans are and where their values lie. Note that we're making

assumptions here, based off the fact that L.L. Bean didn't do anything

particularly newsworthy during the time of their search spikes (Nov. - Dec. 2017).

|

| Spikes indicate high volumes of "L.L. Bean" Google searches. Data source: Google Trends |

Beyond the numbers and charts, I've learned that L.L. Bean's most important followers are true outsiders. They're active farmers, fishers, hunters, campers and hikers who rely on L.L. Bean's gear to last, even when put to the test. These consumers were loyal to L.L. Bean before their recent spike in popularity, and they will remain loyal -- but only if L.L. Bean can successfully navigate their new policy.

Customer Interest in L.L. Bean Following the News

What's interesting is that the news coverage (and outcry) of Bean's new return policy has the world a bit more interested in the company overall. According to Google Trends, the terms "L.L. Bean", and especially "Bean Boot" are of interest over the past seven days, and not just in the regions where Bean's gear is sold.

Take a look at both global maps, left. Google Trends quantifies searches of the phrase "Bean Boot" using either light blue, medium blue or deep blue hues. The top map shows web searches of "Bean Boot" over 30 days; the second image shows the same web search over 7 days (2/11 - 2/18). 7 days in, immediately following the policy change announcement. The world's interest is clearly piqued, and how L.L. Bean handles their return policy change in February 2018 is critical.

You will notice that the same countries have searched the term, during both time periods. However, the overall darkening of countries shows that more countries are Googling the Bean Boot overall.

What the Groundswell is Saying

What's more telling than the quantitative data and charts, is how customers are reacting qualitatively via social media. L.L. Bean's new social media platforms (namely Instagram) have provided a place, much like an online forum, for their fans to vocalize their thoughts through the comments sections of their photos. Most are negative, citing outrage over the new policy. Their Facebook does not reflect this level of vocal engagement. Several comments even result in consumer-to-consumer conversations, either 1.) expressing joint frustration at the brand, or 2.) debating about whether or not consumers have the right to be frustrated at the brand. There have been two instances of the latter since January 15, 2018.

Strengths: L.L. Bean has a loyal following that spans every generation. They have also built up an impressive social media empire over the last several years, with over 225k Instagram followers, 62.1k Twitter followers and 920k "likes" on Facebook. These two factors combined make for a strong company who understands how to manage customer relations. |

| Data source: Google Trends |

For better or for worse, L.L. Bean's policy change resulted in increased popularity online. The chart to the right represent Google searches worldwide, from January 18 2018 through February 18 2018. The peaks in early February align perfectly with the timing of L.L. Bean's return policy announcement, denoting a clear spike in interest (be it good or bad).

|

| 30 Days (spanning 1/18/2018 - 2/18/2018) |

What's interesting is that the news coverage (and outcry) of Bean's new return policy has the world a bit more interested in the company overall. According to Google Trends, the terms "L.L. Bean", and especially "Bean Boot" are of interest over the past seven days, and not just in the regions where Bean's gear is sold.

|

| 7 Days (spanning 2/11/2018 - 2/18/2018) |

You will notice that the same countries have searched the term, during both time periods. However, the overall darkening of countries shows that more countries are Googling the Bean Boot overall.

What the Groundswell is Saying

Interestingly enough, L.L. Bean's following has increased substantially since their policy change announcement. According to SocialBakers.com, L.L. Bean's online following increased by a rough 5,000 users each month from September 2017 to February 2018. This increase in fans plateaued slightly during the middle of December 2017 (which is also just about when their Google searches began to die down, according to the first Google Trends graph above). However, on February 9th 2018 -- the day L.L. Bean formally unveiled their new return policy -- their following grew at an increased pace.

SWOT Analysis

| The yellow line is February 9 2018. Data source: Social Bakers |

|

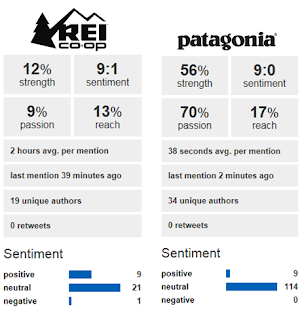

| Data source: SocialMention.com |

Social Mention's data also presents promising trends: despite the negative comments on Instagram accounts, L.L. Bean's reputation online seems to be faring OK in the face of their return policy change. The strength of the search term "L.L. Bean Return Policy" has 0% strength which can indicate that users are more interested in the brand than what's buzzing around them in the news. 2 days per average mention and 0:1 sentiment is also a trend working in their favor.

SWOT Analysis

Weaknesses: The same social media empire that has helped L.L. Bean win over trend-conscious Millennials can easily be used against them, if they don't tread carefully. Much like customer forums, their social media posts' comments sections can easily become overrun with complaints, ill wishes and woes which could then drive away potential customers or worse, begin to influence longstanding ones. They also stand to lose their unique reputation. If the groundswell decides that the lifetime return policy is what separated L.L. Bean from the rest, they risk blending in with other competitor brands (REI, Patagonia, Land's End, Eddie Bauer and the like).

|

| Data source: SocialMention.com |

Threats: L.L. Bean's biggest threats are their own customers and their competitors. Customers can use word-of-mouth to discourage other customers from bringing their business to L.L. Bean. Competitors may also increase their own customer engagement campaigns and sales, in an effort to win over L.L. Bean customers. Their largest threat stems from competitor companies who have a lifetime guarantee or lifetime return policy, as these companies will no doubt use this as an opportunity to self-promote in an effort to distinguish themselves from L.L. Bean.

In Conclusion...

I won't lie, it has been incredibly interesting to watch how L.L. Bean's customers have engaged with their media, and reacted to the return policy change. Now, as we approach March, I'm interested to see what the company does (or doesn't do) differently to engage with their fans. Will their strategy change? Will their posts ramp up, or change focus? Will they continue to share information and communicate about their new policies, or choose to remain tight-lipped on it and focus on merchandise instead? Only time will tell, but one thing is for certain: how L.L. Bean chooses to handle the next few months may mean the difference between losing and gaining customers.

Comments

Post a Comment